Minimalist Personal Finance Effective Organization Strategies

Introduction

In a world increasingly cluttered with information and distractions, the concept of minimalism has emerged as a powerful antidote. With a constant barrage of data and obligations competing for our attention, it can be challenging to maintain clarity and focus. This is where minimalism steps in, offering a reprieve from the chaos and inviting simplicity back into our lives. One critical area where minimalist principles can have a profound impact is effective personal finance management. Embracing a minimalist approach in finance encourages us not only to simplify but also to rationalize our choices, eliminating the unnecessary burdens that financial clutter often brings.

At the heart of minimalism’s essence in finance is the idea of simplifying choices and honing in on what genuinely matters. It’s about making deliberate, conscious decisions with money rather than getting swept away by habitual or impulsive actions. By reducing financial clutter, individuals gain greater control over their resources and can significantly enhance their overall peace of mind and well-being. The beauty of this approach lies in its ability to free individuals from the mental weight of excess, making room for more intentional living.

In this article, we will delve into five essential strategies for organizing your finances in a minimalist and effective manner. These strategies range from practical budgeting techniques that declutter the mind to systematic approaches for reducing unnecessary financial records that no longer serve you. With these methods, you won’t just simplify your financial life—you’ll empower yourself to make well-informed, purposeful decisions. By adopting these minimalist strategies, you’ll be equipped to take charge of your financial life, moving forward with clarity and purpose.

DISCOVER MORE: Click here for effortless cleaning tips

Top 5 Personal Organization Strategies for Managing Finances in a Minimalist and Effective Way

In today’s fast-paced and consumer-driven world, finding a balance between managing personal finances efficiently and living a mindful life can seem challenging. However, adopting a minimalist approach to financial management offers a pathway to simplify not just your finances, but also your life. This article explores five key strategies that will help you manage your finances effectively, while embracing a minimalist mindset that fosters financial well-being and peace of mind.

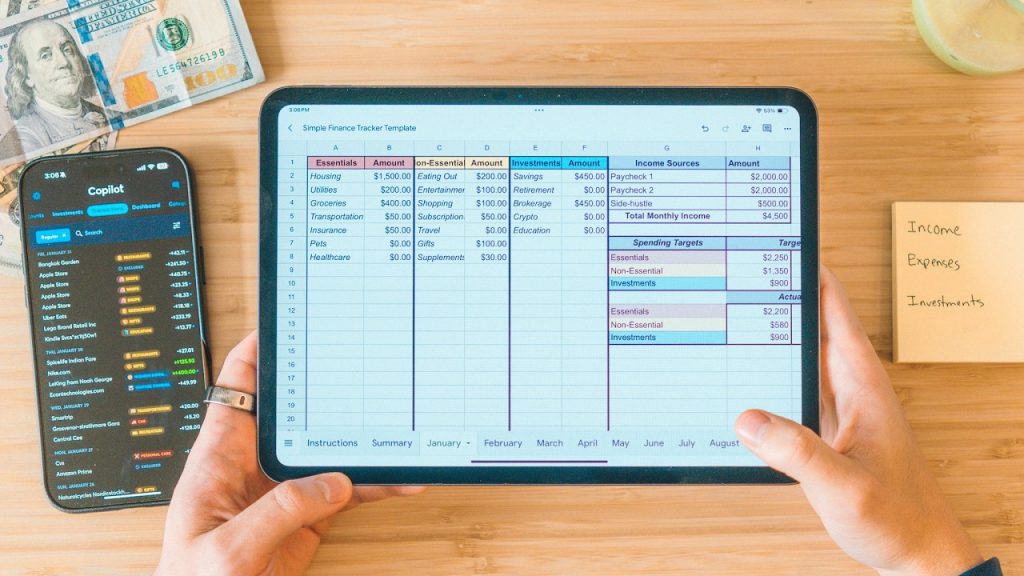

5. Digital Expense Tracking

In an era where technology intertwines intricately with everyday life, digital tools are revolutionizing the way we manage our expenses. Digital expense tracking apps have emerged as a cornerstone for anyone looking to adopt a minimalist approach to financial management. By leveraging these tools, you can easily monitor your spending without the tedious task of handling paper receipts.

These applications provide *real-time tracking of expenses*, which allows you to make informed financial decisions on the go. Additionally, apps like Mint and YNAB (You Need A Budget) offer customization features for spending categories. The ability to generate detailed reports on your financial habits enables a deep dive into your spending patterns, highlighting areas ripe for cost-cutting. These insights are invaluable for reducing unnecessary expenditures, thus aligning well with minimalist values.

Case Study: A Day in the Life of a Digital Tracker

Imagine logging into your preferred app and seeing a detailed pie chart of your monthly expenses. Visual categorizations illuminate where each dollar is being spent. Is dining out a recurring expense? Perhaps grocery spending could be optimized? Through pinpoint accuracy, you’re empowered to redirect your finances toward savings or meaningful experiences, embodying minimalist principles daily.

4. 30-Day Spending Rule

The 30-day spending rule is a philosophy that injects discipline into your purchasing habits. In essence, it’s a cool-off period designed to combat impulsive buying, a prevalent issue in the age of immediate gratification. By pausing for 30 days before making a non-essential purchase, you introduce a reflective buffer to evaluate necessity.

During this time, consider key questions: Does this purchase truly address a need, or is it just a fleeting want? This rule transforms your thinking—shifting focus from momentary desires to what truly matters. Over time, adopting this practice results in a reduced accumulation of ‘stuff,’ helping you to pursue a life enriched by experiences, not possessions.

Example: The Journey of Wanting

You’ve been eyeing the latest gadget, tempted by slick advertisements. Instead of clicking ‘buy now,’ activate the 30-day rule. As weeks pass, you might realize existing gadgets offer sufficient utility, thus saving you money and space. The product that seemed essential now feels superfluous. This buying pause cultivates a habit of delayed decisions leading to intentional, value-based purchasing.

3. Simplified Budgeting Method

The simplified budgeting method, such as the renowned 50/30/20 rule, offers a straightforward blueprint for financial management. Through this strategy, you allocate 50% of your income towards essential needs, 30% towards wants, and 20% for savings and debt repayment. Its intuitive nature simplifies budgeting for those overwhelmed by complicated financial tools.

Simplicity in budgeting encourages a deeper understanding of where your money is going and why. This method reduces financial clutter and promotes accountability, ensuring funds are channeled into areas resonating with your personal values and aspirations. Realigning your financial priorities can be empowering, particularly from a minimalist stance.

Illustrative Scenario: Applying the 50/30/20 Rule

Each month, your income is approximately $3,000. Under this guideline, $1,500 is allocated for necessities like housing and groceries, $900 for discretionary spending such as entertainment, and $600 for savings or debt. This simplistic approach provides clarity and peace of mind, essential components in crafting a deliberate financial narrative.

2. Decluttering Financial Obligations

Minimalism transcends physical decluttering, extending to your financial obligations as well. By adopting the practice of decluttering financial obligations, you audit recurring expenses such as subscriptions, memberships, and automated services. These ongoing payments can often be overlooked, quietly draining your resources.

Engage in a thorough evaluation to identify and cancel unnecessary commitments. This reduces not just expenses but mental load, ushering in simplicity to your financial landscape. Consider negotiating better terms for remaining obligations or consolidating debts to reduce complexity and interest rates, aligning your fiscal responsibilities with minimalistic values.

Real-World Application: Pruning the Financial Garden

Imagine scrutinizing a monthly statement, uncovering a forgotten magazine subscription and multiple streaming services overlapping in content. Upon rationalizing, you identify those truly being used and beneficial, thereby eliminating redundant expenditures. This exercise underscores the power of trimming financial redundancies, directing funds to what holds genuine value.

1. Mindful Spending Practices

At the pinnacle of effective minimalist financial strategies lies the philosophy of mindful spending practices. This method emphasizes intentionality and awareness in purchasing decisions, urging an honest evaluation of necessity, personal value, and redundancy prior to engagement.

Mindful spending is a powerful tool for cultivating appreciation for every purchase, preventing the rampant accumulation of unessential items. When each outlay is underpinned by thoughtful consideration, you nurture a lifestyle harmonious with your ideals and financial goals. This intuitive alignment cuts through the noise of external pressures, fostering gratification rooted in experiences and authentic needs.

Reflective Practice: The Mindful Shopper

Facing an enticing sale, instead of succumbing to immediate discounts, you pause. Do you genuinely need that additional wardrobe item? Or is it a reflexive purchase driven by temporary desires? By requiring a self-imposed reflection, mindful spending reinforces a powerful narrative: financial choices should be meaningful, enhancing your life rather than complicating it.

In conclusion, the integration of these personal organization strategies facilitates a transformation in how we manage finances. By approaching fiscal responsibilities with a minimalist and intentional mindset, you foster a landscape where financial and personal satisfaction flourish. Start embracing these strategies today to reshape your financial journey with clarity and purpose.

| Category | Details |

|---|---|

| Budgeting Techniques | Implementing a zero-based budgeting system can enhance awareness of every dollar spent, while maintaining a minimalist focus on essentials. |

| Decluttering Expenses | Regularly auditing subscriptions and services leads to eliminating unnecessary costs, simplifying monthly expenses. |

| Automated Savings | Setting automatic transfers to a savings account assists in creating a financial buffer without manual intervention. |

| Mindful Spending | Adopting a conscious approach to purchasing fosters better financial decisions, ensuring spending aligns with personal values. |

In adopting these personal organization strategies for managing finances, it is essential to examine various methodologies that resonate with a minimalistic approach. Budgeting techniques such as zero-based budgeting can empower individuals to account for every dollar, promoting intentional spending that cultivates financial responsibility. This method encourages reflection on needs versus wants, allowing for a more streamlined financial pathway.Decluttering expenses stands as another powerful method within this paradigm. Regular reviews of subscriptions and recurring payments can unveil hidden costs that detract from essential expenditure. By identifying and eradicating unnecessary expenses, individuals can not only simplify their financial commitments but also redirect those funds towards more meaningful goals.Moreover, the integration of automated savings into one’s financial regimen serves as a game-changer. By scheduling automatic deposits into savings accounts, individuals can ensure that their future security is prioritized, often without the need for active engagement in day-to-day financial decision-making. This effortless approach can build a robust financial cushion over time, reinforcing the idea of minimalism through simplicity.Lastly, cultivating a practice of mindful spending is crucial. By aligning purchases with personal values, individuals not only enhance their overall satisfaction but also minimize impulsive financial decisions. This focus on conscious consumption cultivates not only a healthier relationship with money but also fosters ongoing self-reflection about what truly brings value to one’s life.Investing time in these strategies can lead to more efficient management of finances, aligning perfectly with a minimalistic lifestyle that champions simplicity and effectiveness. Each of these strategies helps weave a fabric of financial well-being that stands resilient against the distractions of consumerism.

DISCOVER MORE: Click here for top tips to declutter your inbox

Frequently Asked Questions about Minimalist and Effective Personal Finance Management

How can minimalism contribute to better financial management?

Minimalism can significantly enhance financial management by promoting a focus on essential expenses and reducing impulsive purchases. By adopting a minimalist approach, individuals are encouraged to value quality over quantity, leading to fewer acquisitions but of greater personal significance. Moreover, minimalism often involves decluttering, which can uncover unnecessary subscriptions or redundant financial obligations, providing an opportunity to reinvest those funds more productively.

What are the first steps to implementing a minimalist finance strategy?

Starting a minimalist finance strategy begins with assessing your financial landscape. This involves tracking all current expenditures and income sources to gain a comprehensive understanding of your financial status. Once this is established, identify and prioritize expenses that fulfill crucial needs while eliminating those that do not contribute to your core values or long-term financial goals. Setting specific, achievable budget plans is the next step to ensuring controlled spending and advancing savings.

How can one effectively prioritize financial goals in a minimalist lifestyle?

In a minimalist lifestyle, it’s crucial to align financial goals with personal values and essential needs. Start by distinguishing between needs, wants, and obligations. Aim to focus on goals that provide the most significant impact on your life quality and financial security. This may involve streamlining debt repayment, building an emergency fund, or saving for experiences rather than material possessions, which inherently aligns with minimalist ideologies.

What tools and techniques can assist in maintaining minimal and effective finance management?

Several tools and techniques can aid in this endeavor, such as utilizing budget tracking apps to monitor expenses against income in real-time. These tools often offer visual reports that help in understanding spending trends and making informed financial decisions. Additionally, techniques like the 50/30/20 rule can be applied, which allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayments, thus balancing financial responsibility with flexibility.

DISCOVER MORE: Click here for tips to streamline your productivity

Conclusion

In the quest for financial stability and simplicity, adopting minimalist and effective personal organization strategies can significantly transform one’s financial landscape. As highlighted throughout the article, the journey begins with developing a clear understanding of one’s financial state, setting realistic goals, and establishing a budget that mirrors both present needs and future aspirations. This foundational step ensures clarity and sets the tone for all subsequent actions.

Another pillar of success lies in the constant tracking of expenses. By diligently monitoring where every dollar goes, individuals can identify potential overspending areas and make informed decisions that align with their minimalistic priorities. Using tools like apps and spreadsheets can simplify this process, turning it into an insightful routine rather than a cumbersome task.

The commitment to decluttering financial obligations cannot be overstated. Reducing unnecessary subscriptions and simplifying investment portfolios not only frees financial resources but also cleanses mental clutter, allowing for a sharper focus on what truly matters. Additionally, adopting automated savings and investments reduces the cognitive load of manual interventions, consistently steering efforts towards long-term growth.

Finally, the power of mindfulness in financial decisions reinforces the minimalist approach. Pausing before purchases and assessing their true value and necessity can prevent impulsive buys that contribute to financial chaos.

By embracing these strategies, anyone can pave the way to a more organized, less stressful financial life. The beauty of a minimalist approach lies not only in managing finances effectively but also in enhancing overall life quality. As individuals delve deeper into these strategies, they discover a harmonious balance between financial freedom and life satisfaction—an intriguing avenue worth exploring further.